MYRTLE BEACH, SC, October 23, 2018 — South Atlantic Bancshares, Inc. (“South Atlantic”) (OTCQX:SABK), announced today the results of its operations for the third quarter ended September 30, 2018.

Financial Highlights

- Net operating return on average assets (non-GAAP) of 0.78 percent for the nine months ended September 30, 2018, the best performance in company history.

- Net interest margin, taxable equivalent, of 4.26 percent, a 26 basis point, or 7 percent, increase from a year ago.

- Asset quality continues to be a highlight with nonperforming assets to total assets of 0.13 percent.

- Total loans grew 20.4 percent, to $512.5 million at September 30, 2018 from $425.6 million at September 30, 2017, primarily due to the acquisition of Atlantic Bancshares, Inc. (“Atlantic Bancshares”) in the second quarter of 2018. Organic loan growth from all markets was 9.6 percent for the first nine months of 2018 compared to the first nine months of 2017.

- Total deposits grew 18.6 percent, to $527.2 million at September 30, 2018 from $444.5 million at September 30, 2017, primarily due to the acquisition of Atlantic Bancshares. Our organic deposit growth was 3.3 percent for the first nine months of 2018 compared to the first nine months of 2017, with growth in each market we operate.

- Total assets grew 20.7 percent to $617.8 million at September 30, 2018 from $511.7 million at September 30, 2017, primarily due to the acquisition of Atlantic Bancshares. Organic total asset growth was 3.93 percent for the first nine months of 2018 compared to the first nine months of 2017.

K. Wayne Wicker, chairman and chief executive officer, stated: “During the third quarter, we continued our loan growth while maintaining a very strong net interest margin and increased demand deposits across all markets. September was a trying month for our communities and employees. We are proud of the way our team handled the impact of Hurricane Florence and the subsequent flooding. Our corporate culture of service and citizenship was evident during this crisis.”

3Q 2018 Financial Highlights

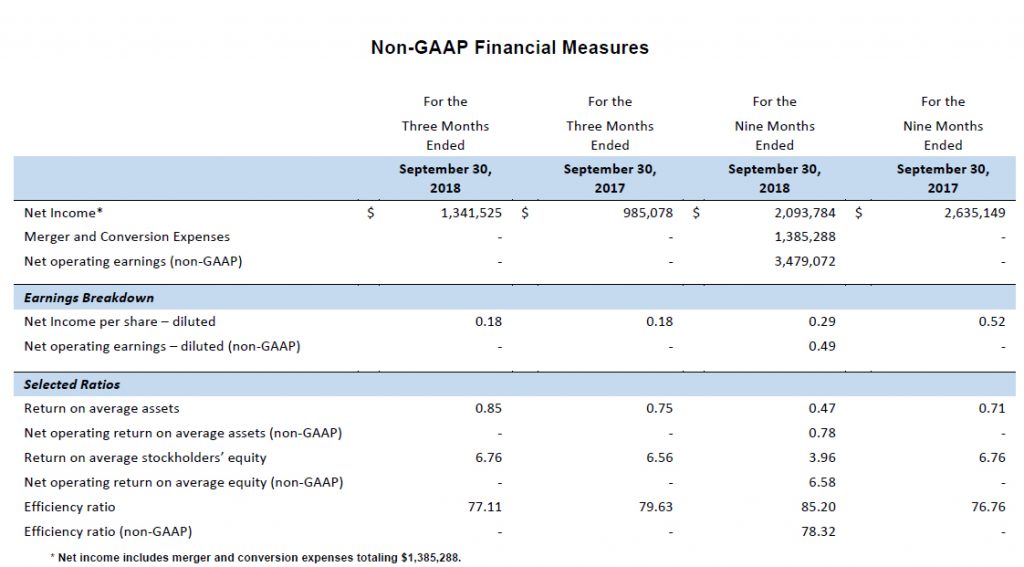

Net operating earnings (non-GAAP) for the nine months ended September 30, 2018 totaled $3.5 million or $0.49 per diluted common share. Net income for the nine months ended September 30, 2018 was $2.1 million, which includes one-time charges of $1.4 million in merger and conversion expenses booked in the second quarter of 2018, or $0.29 per common share.

Net income for the three months ended September 30, 2018 totaled $1.3 million compared to $985 thousand for the same period in 2017. For the quarter, net income per common share was $0.18, compared to $0.18 for the same quarter in 2017.

Net Interest Income and Net Interest Margin

Net interest income to average assets was 3.92 percent and 3.66 percent for the nine months ended September 30, 2018 and 2017, respectively. Net interest income totaled $17.4 million in the first nine months of 2018

compared to $13.5 million for the same period in 2017. Net interest margin, taxable equivalent, increased from 4.00 percent for the nine months ended September 30, 2017 to 4.26 percent for the same period in 2018. Increases in

net interest income and net interest margin are attributed to loan growth and interest rate increases during the period.

Net interest income to average assets of 4.02 percent for the quarter increased from 3.67 percent in the third quarter of 2017. Net interest income for the third quarter totaled $6.4 million and $4.8 million in 2018 and 2017,

respectively. Net interest margin, taxable equivalent, increased from 3.99 percent in the third quarter of 2017 to 4.37 percent in the third quarter of 2018. Improvements in net interest income and net interest margin for the

quarter are attributed to increases in the yield on earning assets.

Noninterest Income and Expense

Noninterest income totaled $2.7 million and $2.4 million for the first nine months in 2018 and 2017, respectively. Noninterest income for the third quarter of 2018 totaled $871 thousand and $836 thousand for 2018 and 2017, respectively. The increases in noninterest income were related to an increase in mortgage operations income.

Noninterest expense was up during the first nine months of 2018 at $17.1 million from $12.2 million in 2017. For the quarter, noninterest expense totaled $5.6 million compared to $4.5 million in 2018 and 2017, respectively. These increases are attributed to the merger & conversion expenses and completion of Charleston market headquarters.

The effective income tax rate for the quarter was 21.2 percent for 2018 as compared to 37.0 percent in 2017. The lower rate primarily reflects the benefit from a reduction of the US federal corporate income tax rate by the Tax Cuts and Jobs Act. Our effective tax rate for the first nine months of 2018 was 20.6 percent compared to 19.0 percent for the first nine months of 2017.

Loan Loss Provision

Provision for loan losses for the nine months ended September 30, 2018 and 2017, respectively, was $325 thousand and $450 thousand. The decrease in provision is primarily a reflection of the company’s excellent asset

quality and treatment of the reserve related to the merger. Provision for loan losses for the quarter totaled $110 thousand and $165 thousand for 2018 and 2017, respectively. The allowance for loan and lease losses at

September 30, 2018 was $4.1 million or 0.80 percent of total loans as compared to $3.3 million or 0.77 percent of total loans at September 30, 2017.

Nonperforming Assets

Nonperforming assets as a percentage of average assets was 0.14 percent and 0.02 percent for the nine months ended September 30, 2018 and 2017, respectively. For the third quarter, nonperforming assets as a percentage of

average assets was 0.13 and 0.02 for 2018 and 2017, respectively. In addition to the allowance, there were $1.6 million additional discounts on $59.1 million of loans acquired with the purchase of Atlantic Bancshares as of

September 30, 2018.

About South Atlantic Bancshares, Inc.

South Atlantic Bancshares, Inc., (OTCQX: SABK) is a registered bank holding company based in Myrtle Beach, South Carolina with $617.8 million in assets. The company’s banking subsidiary, South Atlantic Bank, is a full

service financial institution spanning the entire coastal area of South Carolina, and is locally owned, controlled, and operated. The bank operates nine offices in Myrtle Beach, North Myrtle Beach, Murrells Inlet, Pawleys Island, Georgetown, Mount Pleasant, Charleston, Hilton Head Island, and Bluffton, South Carolina. South Atlantic Bank specializes in providing personalized community banking services to individuals, small businesses and corporations.

Services include a full range of consumer and commercial banking products, including mortgage, and treasury management, including South Atlantic Bank goMobile, its mobile banking app. The bank also offers online banking, checking, CD, and money market accounts, merchant services, mortgage loans, remote deposit capture, and more. Recruiting the best people, delivering exceptional client service, strategic branching and a disciplined approach to lending have contributed to South Atlantic Bank’s success. For more information, visit www.Southatlantic.bank

Non-GAAP Financial Matters

Statements included in this press release include non-GAAP financial measures and should be read along with the accompanying tables, which provide a reconciliation of non-GAAP financial measures to GAAP financial measures. South Atlantic management uses several non-GAAP financial measures, including (i) net operating earnings available to common shareholders, (ii) net operating return on average assets, and (iii) net operating return on average equity, in its analysis of the company’s performance. Net operating earnings available to common shareholders excludes the following from net income available to common shareholders: merger and conversion expenses.

Management believes that non-GAAP financial measures provide additional useful information that allows readers to evaluate the ongoing performance of the company and provide meaningful comparisons to its peers. Non-GAAP financial measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider South Atlantic’s performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the company. Non-GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the results or financial condition as reported under GAAP.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains, among other things, certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements preceded by, followed by, or that include the words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “projects,” “outlook” or similar expressions, including statements related to the integration of Atlantic Bancshares. These statements are based upon the current beliefs and expectations of the company’s management

team and are subject to significant risks and uncertainties that are subject to change based on various factors (many of which are beyond the company’s control). Although the company believes that the assumptions

underlying the forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate.

Therefore, the company can give no assurance that the results contemplated in the forward-looking statements will be realized. The inclusion of this forward-looking information should not be construed as a representation by the company or any person that the future events, plans, or expectations contemplated by the company will be achieved. All subsequent written and oral forward-looking statements attributable to the company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. The company does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law.

Information contained herein, other than information at December 31, 2017, and for the twelve months then ended, is unaudited. All financial data should be read in conjunction with the notes to the consolidated financial statements of the company and South Atlantic Bank as of and for the fiscal year ended December 31, 2017, as contained in the company’s 2017 Annual Report located on the company’s website.

View 2018 Third Quarter Financial Highlights

MYRTLE BEACH, SC, January 23, 2019 – South Atlantic Bancshares, Inc. (the “Company”) (OTCQX:SABK), announced today the results of its operations for the year ended December 31, 2018. Highlights include: Net operating return on average assets (a non-GAAP financial measure) of 0.80 percent for the year ended December 31, 2018, the best performance in Company […]

Learn More About Year-End Earnings 2018MYRTLE BEACH, SC, July 25, 2018 — South Atlantic Bancshares, Inc. (“South Atlantic”) (OTCQX:SABK), announced today the results of its operations for the second quarter ended June 30, 2018. Financial Highlights Net operating return on average assets (non-GAAP) of 0.75 percent for the six months ending June 30, 2018, the best performance in company history. […]

Learn More About Mid-Year Earnings 2018We're here to help you. Visit our Help Center to find important information and frequently asked questions.

Visit Help CenterReady to make the switch? Open a new account with South Atlantic Bank.

Open an Account Now